ABSTRACT

This study investigates the relationship between inflation and sectoral stock indices in India, focusing on HDFC, ICICI, Infosys, and Tata Motors, against the backdrop of limited and inconclusive evidence in emerging markets. Monthly data from 2014 to May 2024 on inflation, GDP growth, and sectoral indices were analyzed using Ordinary Least Squares regression, Kendall’s tau-b correlation, and SARIMA forecasting with SPSS and Python. Results show statistically insignificant coefficients (p > 0.05) and very low R-squared values (<0.005), suggesting that inflation has negligible explanatory power over stock prices. Correlation and visual analyses further confirm weak, inconsistent relationships, with firm- and sector-specific variations. The study concludes that inflation alone does not significantly influence Indian stock indices, and broader macroeconomic variables such as interest rates, fiscal policy, global cues, and firm fundamentals better explain market dynamics. Future research should adopt panel models incorporating diverse indicators like crude oil prices, FDI, repo rates, and employment indices to yield more robust insights.

INTRODUCTION

The Indian stock market, encompassing the NSE and BSE, is deeply influenced by various macroeconomic parameters. Among these, inflation plays a pivotal role in investor sentiment and stock price movements. This paper builds traditional theories and expands the inquiry through advanced econometric tools, updated with 2024 data, to assess whether inflation retains any explanatory power over sectoral indices.

The Indian stock markets, which comprise the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), are a thriving and dynamic ecosystem that is crucial to the country’s financial and economic landscape. Since the establishment of the BSE in 1875, the Indian stock markets have developed into one of the biggest and most liquid in the world, offering investors a wide choice of investment possibilities across asset classes and industries. The Indian stock markets are a crucial venue for wealth creation, capital formation, and corporate governance because of their robust regulatory frameworks, advancements in technology, and growing investor participation.

The Indian stock markets give businesses, from established multinationals to emerging start-ups, a way to raise capital, expand, and create value for their investors. The Indian stock market is well-positioned for future expansion and innovation due to the country’s rapidly urbanising population, expanding middle class, and more engagement with international markets. This gives investors a chance to take part in India’s economic recovery and long-term prosperity. The link between inflation and macroeconomic indices, including GDP, the broad money supply, per capita income, and the stock market index, has been studied by several economists in the public, commercial, and academic sectors. Over time, monetisation leads to an increase in the monetary supply, which raises inflation. Global history has been impacted by the increased focus on inflation in many nations, especially India.

India’s economy has always been prone to inflation. Inflation impacts the GDP figure without any changes. Inflation is the gradual but unavoidable increase in the cost of goods and services. When prices rise, both the buying power of money and the value of financial assets fall. From a different perspective, an increase in inflation leads the stock valuation the model’s discount rate to rise, lowering share prices, encouraging monetary and fiscal policies to restrain aggregate demand by reducing the money supply, and raising interest rates. Growth rate, corporate performance, or stock returns would all suffer as a result. The cost of living index rises in parallel with inflation, reducing purchasing power. High inflation rates indicate low real money value, lower consumer purchasing power, falling profitability, and poor real investment returns. This study investigates the relationship between inflation and its effects ICICI, HDFC, Infosys, and Tata Motors stock indices.

Review of Literature

Fama (1970) defined an efficient market as one in which stock prices fully reflect all available information. Extending this, Fama and Schwert (1977) discovered an inverse relationship between inflation expectations and stock performance, attributing the decline in equity values to reduced savings and investments caused by increased consumer spending amidst rising prices. This pattern was further substantiated by Fama (1981), who emphasised that inflation erodes corporate profitability through increased input costs and debt servicing, leading to suppressed stock valuations. However, contrasting perspectives emerged from Pearce and Roley (1985) and Hardouvelis (1988), who found no significant association between inflation and equity markets. Chatrath et al., (1997) refined this narrative by distinguishing between anticipated and unanticipated inflation, asserting that while expected inflation may be hedged by stock returns in India, unexpected inflation tends to adversely affect them. Schotman and Schweitzer (2000), using Fisher’s hypothesis, explored this linkage over extended periods and found evidence supporting a long-term inflation-stock market relationship. Mallik and Chowdhury (2001) extended this inquiry to four South Asian economies, revealing that moderate inflation may support GDP growth. Meanwhile, researchers like Corrado and Jordan (2002) and Srinivasan (2011) have argued that inflation is just one among many macroeconomic factors-such as GDP, interest rates, money supply, and oil prices-that influence equity markets, often in a sector-specific or company-specific manner. Khan and Yousuf (2013) concluded that inflation’s effect on Indian stock prices is weak or negligible when compared with other macroeconomic variables, underscoring the complexity and multifactorial nature of stock price movements.

Research Gap

While extensive academic literature has explored the relationship between inflation and stock market performance globally, much of this research has been concentrated in Western economies, leaving emerging markets like India relatively underrepresented. The structural differences in economic frameworks, monetary policy regimes, and investor behaviour necessitate localised investigations. Despite global consensus on the theoretical impact of inflation on equity returns, empirical evidence in the Indian context remains limited and often inconclusive. This study seeks to address this gap by systematically analysing how inflation affects sectoral stock indices in India, using updated data and robust econometric techniques. By doing so, it aims to provide meaningful insights for domestic investors, policymakers, and corporate strategists who must navigate an increasingly volatile macroeconomic environment.

Scope and Objectives of the Study

- To investigate whether inflation impacts GDP.

- To examine how inflation affects the stock indices of chosen companies.

Further research on the inflation rate, GDP rate, other macroeconomic indicators, sectoral stocks, their interrelationships, and the outcomes of stock price decisions would be extremely beneficial to investors, policymakers, and businesses. Inflation, or the rate at which the overall level of prices for goods and services rises, can have a substantial impact on stock markets.

Theoretical Study

The relationship between inflation and stock markets is complex and diverse, with investor sentiment, interest rates, and corporate earnings all having an impact. Moderate inflation can improve corporate profitability by increasing pricing power and boosting revenue. During periods of mild inflation, businesses may be able to pass on increasing expenses to customers through price increases, resulting in increased revenues and potentially higher profits. However, high or rising inflation rates may reduce business profitability and the purchasing power of consumers, putting negative pressure on stock values. Consumer staples, healthcare, and utilities industries in India may be less impacted by inflation due to their defensive features. Inflationary pressures can influence shareholder views of company earnings growth, hence affecting stock prices. Inflationary forces can influence the Reserve Bank of India’s (RBI) monetary policy choices, which may include adjusting interest rates to manage expectations of inflation. Changes in interest rates can have an impact on borrowing costs, choices regarding investments, and stock market values, all of which contribute to stock price volatility. Central banks frequently respond to fluctuations in inflation by altering monetary policy, particularly the rate of interest. If inflation exceeds the desired level, central banks may raise rates of interest to decrease economic activity and reduce inflationary pressures. Higher interest rates can raise borrowing costs for businesses, lower consumer spending, and limit economic development, all of which can have a negative influence on the stock market. Lower inflation, on the other hand, may motivate central banks to implement accommodative monetary measures, such as interest rate cuts, in order to boost economic activity and asset values. When considering investment prospects, investors take into account the real (inflation-adjusted) returns on equities. However, as inflation rises, the purchasing power of conventional returns falls, lowering the real returns earned by investors. As a result, investors may seek larger nominal returns from equities to offset the effects of inflation, putting downward pressure on stock prices. Inflation influences the discount rates used in stock valuation designs, such as the discounted cash flow, or DCF, model. Greater inflation rates often result in greater discount rates, lowering the current value of future revenue and earnings. As a result, rising inflation can reduce stock valuations, resulting in lower stock prices. Lower inflation rates, on the other hand, may result in lower discount rates, allowing stock valuations and prices to rise. Inflation can affect investor sentiment and perceptions of risk. High or rising inflation rates may generate concerns about future financial stability, increasing risk aversion among investors. Inflationary pressures can also reduce consumer purchasing power and diminish discretionary spending, resulting in lower business earnings and performance in the stock market. In summary, inflation can effect stock markets via influencing company earnings, discounted interest rates, real comes back sectoral dynamics, and sentiment among investors. Understanding the connection between inflation and stock markets is critical for investors since fluctuations in inflation rates can have a major impact on portfolio returns, asset allocation choices, and risk management techniques. Overall, the impact of inflation on stock prices in the Indian market is linked to broader the state of the economy, monetary policy dynamics, and investment behaviour. While good economic indicators like low inflation tend to encourage higher stock prices, negative ones like excessive inflation or interest rate hikes can have an impact on investor sentiment and stock market performance. Furthermore, differences in sensitivity to macroeconomic factors emphasise the significance of taking sectoral dynamics into account when examining the relationship among macroeconomic variables and stock prices in India.

RESEARCH METHODOLOGY

Monthly data from 2014 to May 2024 were gathered for inflation, GDP growth, and sectoral stock indices. Econometric regression models, Kendall’s tau-b correlation, and SARIMA time-series forecasting were used. SPSS and Python’s Stats Models library were employed for analytical modelling.

Econometric Analysis

Ordinary Least Squares (OLS) regression was applied to evaluate the sensitivity of each stock index to inflation. The results are summarised below:

Table 1 presents the results of the Ordinary Least Squares (OLS) regression analysis conducted to examine the relationship between inflation and the stock indices of selected companies-HDFC, ICICI, Infosys, and Tata Motors. The coefficient values indicate the direction and magnitude of the effect of inflation on each company’s stock price, while the p-values determine the statistical significance of these relationships. As shown, all p-values exceed the standard threshold of 0.05, suggesting that none of the coefficients are statistically significant. For instance, while ICICI shows the highest coefficient (14.1785), its corresponding p-value of 0.4768 indicates that the relationship is not statistically meaningful. Similarly, the R-squared values for all four companies are extremely low (ranging from 0.0004 to 0.0043), implying that inflation explains less than 1% of the variation in stock prices. These findings collectively suggest that inflation, in isolation, does not have a significant explanatory power over the stock performance of the selected firms in the Indian context. This reinforces the need to consider a broader set of macroeconomic and firm-specific variables in future modelling efforts.

| Stock | Coefficient | p-value | R-squared |

|---|---|---|---|

| HDFC | 6.449 | 0.802 | 0.0005 |

| ICICI | 14.1785 | 0.4768 | 0.0043 |

| Infosys | 6.3165 | 0.8208 | 0.0004 |

| Tata Motors | 13.3562 | 0.5438 | 0.0031 |

Sectoral Correlation Analysis

Correlation among sectoral stock indices indicates limited co-movement, suggesting diversified investor behaviour across sectors.

The study included data from different sources from 2014 to 2023, including inflation and stock indices for selected corporations such as HDFC, ICICI, Infosys, and Tata Motors. Kendall’s tau-b correlation was used with SPSS to analyse the results. The null hypothesis (H0) indicated that there is no meaningful association, but the alternative hypothesis (H1) asserted that there is a relationship between the pace of increase in inflation and specific equities in the Indian stock market. All p-values are above 0.05; hence, the null hypothesis stating that there is no relationship between inflation and company stock indices in the Indian stock market must be accepted. It may be argued that inflation is not a deciding factor, and people invest regardless of inflation, which may cause a decrease in investment and spending (Table 2).

| Variables | p-values |

|---|---|

| Inflation and the Stock index of HDFC | .200 |

| Inflation and the Stock index of ICICI | .289 |

| Inflation and the Stock index of Infosys | .244 |

| Inflation and the Stock index of Tata | .333 |

| Inflation and GDP | .156 |

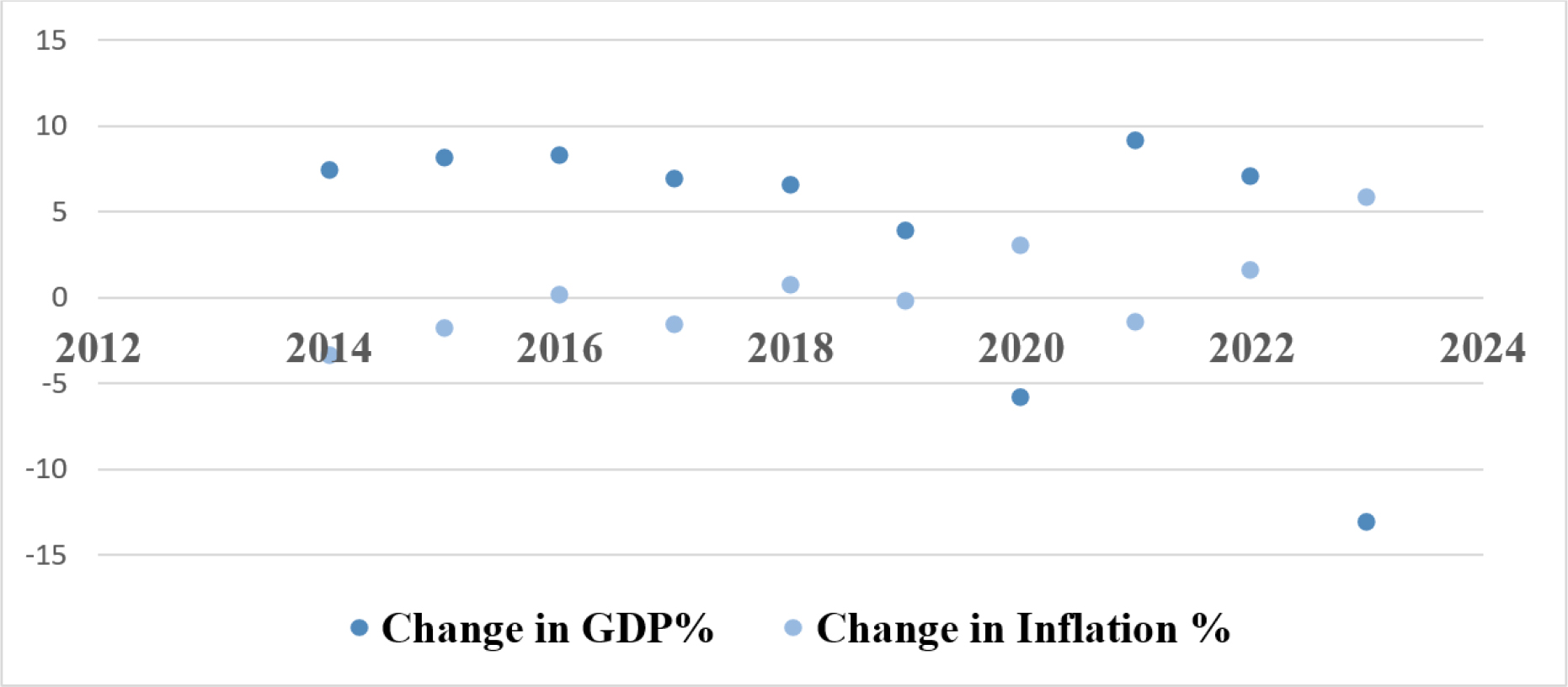

Chart 1 illustrates the annual changes in India’s GDP growth rate and inflation rate from 2012 to 2023. The chart shows two distinct data series-one representing change in GDP (%) and the other for changes in inflation (%). From the visual pattern, it is evident that there is no consistent or strong inverse relationship between the two variables. For instance, during years like 2014-2016 and 2021-2022, GDP growth remained relatively stable while inflation fluctuated. In contrast, in 2020, both GDP and inflation dipped sharply, likely reflecting the economic disruption caused by the COVID-19 pandemic. Notably, the year 2023 shows a sharp decline in GDP growth with inflation moderating, suggesting that factors other than inflation (such as global demand, policy interventions, and sectoral performance) may be driving GDP variation. Overall, the scatter pattern indicates a weak and inconsistent correlation, affirming the empirical result that inflation alone does not adequately explain GDP fluctuations.

Chart 1:

Relation between change in the rates of GDP and Inflation.

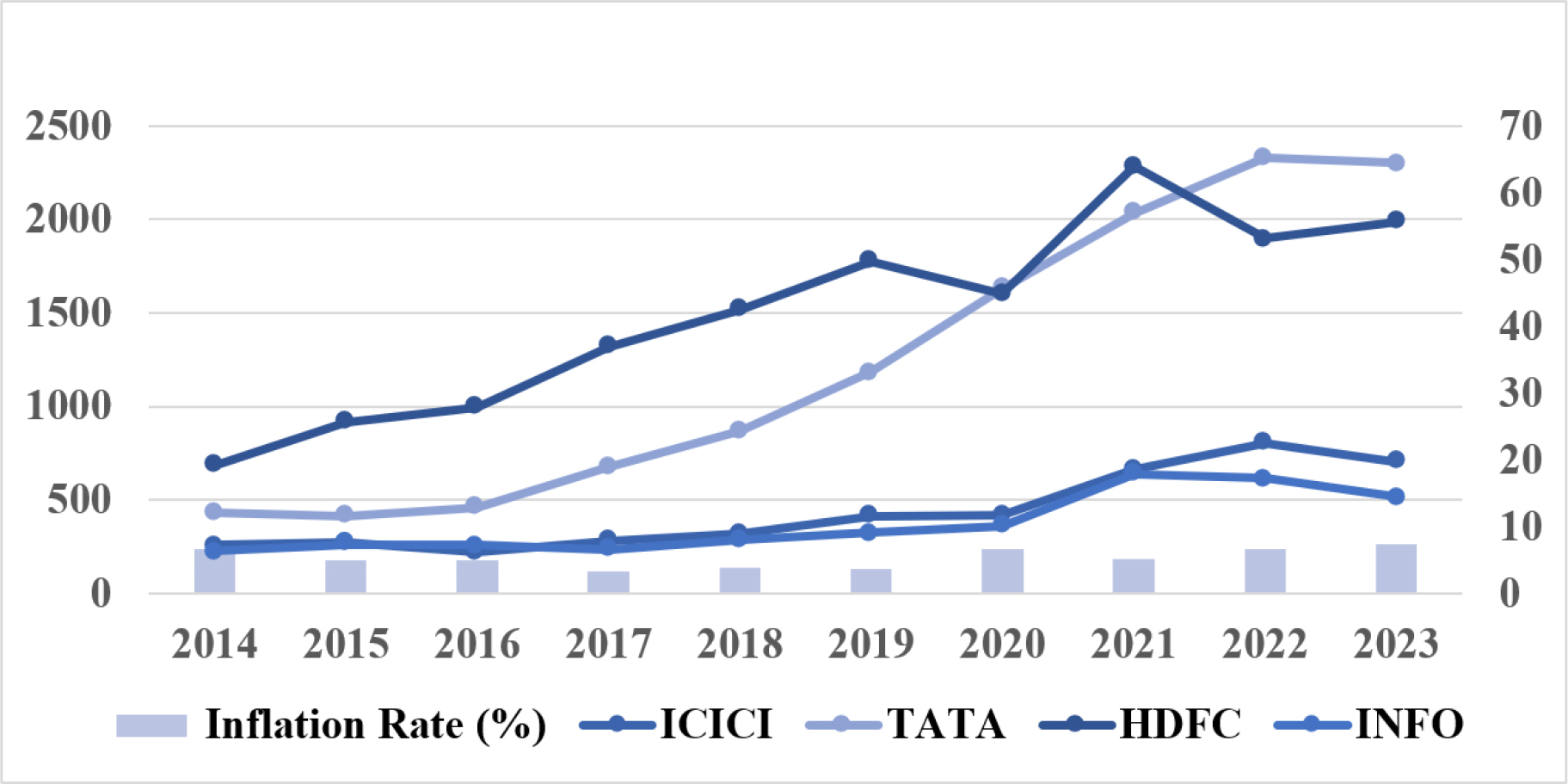

Chart 2 depicts the annual trend of inflation rates (bar graph) alongside the stock indices of four major Indian companies-ICICI, Tata Motors (TATA), HDFC, and Infosys (INFO)-from 2014 to 2023. The inflation rate is plotted on the secondary Y-axis (right), while the stock indices are plotted on the primary Y-axis (left). The visual analysis reveals a divergence between inflation and stock market performance over the observed period. For example, from 2014 to 2021, while the inflation rate remained relatively stable or declined slightly, the stock indices of all four companies-particularly Infosys and ICICI-experienced a steady upward trend, with a notable surge between 2020 and 2021. Interestingly, despite a noticeable increase in inflation in 2021, stock indices continued to rise, suggesting that stock market growth during that period was not hindered by inflationary pressures. However, post-2021, inflation slightly stabilised while stock indices showed modest corrections or plateauing, particularly for Tata Motors and Infosys. Overall, the chart supports the regression results by demonstrating a weak visual correlation between inflation rates and the stock performance of the selected firms. This further reinforces the conclusion that inflation may not be a dominant factor influencing equity prices in the Indian market, and that firm-level or macroeconomic variables such as earnings, sector growth, or monetary policy likely play a larger role.

Chart 2:

Relation between Inflation and Stock Indices.

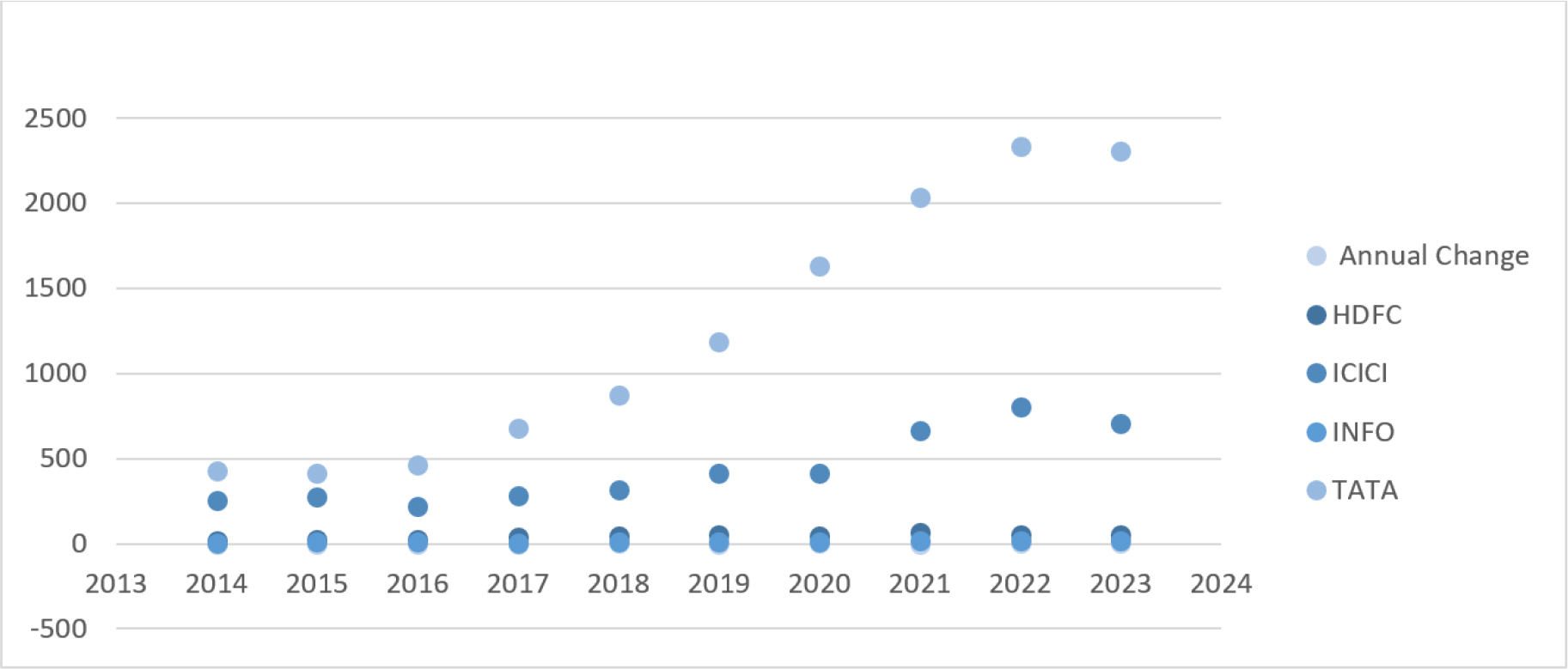

Chart 3 illustrates the annual changes in inflation rates alongside yearly movements in the stock indices of four major Indian companies-HDFC, ICICI, Infosys (INFO), and Tata Motors (TATA)-over the period from 2014 to 2023. The chart uses bubble points to visualise both the volatility in inflation and the corresponding directional shifts in stock index values. From the visual, it is clear that there is no consistent or linear relationship between annual changes in inflation and movements in stock indices. For instance, between 2016 and 2021, when inflation showed modest variability, stock indices-particularly Infosys and ICICI-displayed a strong upward trend. Conversely, during years of sharper inflation rate change, such as 2020 and 2021, the stock indices continued to rise rather than decline, which would typically be expected if inflation had a dampening effect on stock performance. Additionally, the spread between companies indicates sectoral and firm-specific differences in inflation sensitivity. While Infosys and ICICI show significant growth despite inflation changes, Tata Motors and HDFC reflect comparatively muted or irregular movements, suggesting differing exposure to macroeconomic volatility. Overall, this chart reinforces the earlier econometric results: changes in inflation do not exhibit a strong or predictable impact on sectoral stock indices, and thus inflation alone may not be a reliable predictor of stock price movements in the Indian market.

Chart 3:

Relation between Change in Inflation Rate and Stock Indices.

CONCLUSIONS AND RECOMMENDATIONS

The study concludes that inflation does not exert a statistically significant influence on selected Indian stock indices. Other variables such as interest rates, fiscal policy, global cues, and monetary measures may better explain stock market dynamics. Further studies should use panel data and integrate variables like FDI, crude prices, repo rates, and employment indices to develop a more robust model.

The analysis reveals that, in addition to growing inflation, a variety of other factors influence changes in stock market indices. Though inflation influences the stock market, other factors influence stock prices. The degree of correlation between inflation and stock market indexes discovered in recent studies, nevertheless, cannot be wrangled. Future research should examine other factors such as monetary and fiscal policy, peer effects, economic headlines from the web, and macroeconomic indicators like GNI, NNI, CPI, WPI, BOT, BOP, money supply, crude oil prices, FDI, FFI, repo rates, reverse repo rates, manufacturing output index, unemployment exchange rates, income per capita, gold rates, interest rates, and residual income, etc., to determine how everything influences the value of stocks in the secondary market.

ACKNOWLEDGEMENT

We express our gratitude to the anonymous reviewers for meticulously reviewing our manuscript and providing us with their valuable comments and suggestions.

References

- Ahuja M., Makan C., Chauhan S.. 2012 MPRA Paper No. 43313. A study of the effect of macroeconomic variables on stock market: Indian perspective.

- AlMusawi R. Y. K.. (2023) Financial inflation on the growth rate of Iraqi output: An analytical study for the years 2011-2020. Google Scholar

- Baranidharan D. S.. (2020) Causal influence of macroeconomics factors shock on Indian stock market: Evidence from BSE Index. Google Scholar

- Chatrath A., Miao H., Ramchander S.. (1997) The impact of unexpected inflation on stock returns. Applied Financial Economics 7: 439-445 https://doi.org/10.1080/096031097333556 researchgate.net+4ideas.repec.org+4econbiz.de+4 | Google Scholar

- Fama E. F.. (1970) Efficient capital markets: A review of theory and empirical work. The Journal of Finance 25: 383-417 https://doi.org/10.2307/2325486 | Google Scholar

- Ghimire T. P.. (2022) Macro-economic variables and effect on stock prices: Correlation evidence from Nepal. https://doi.org/10.2307/2325486 | Google Scholar

- Gupta N., Kumar A.. (2020) Macroeconomic variables and market expectations: Indian stock market. https://doi.org/10.2307/2325486 | Google Scholar

- Islam K. M. Z. (2015) Relationship between inflation and stock market returns: Evidence from Bangladesh. https://doi.org/10.2307/2325486 | Google Scholar

- Jha A. K., Tiwari S.. (2020) Effect of inflation rates on the stock price: Evidence from Indian market. https://doi.org/10.2307/2325486 | Google Scholar

- Khan M. A., Yousuf A.. (2013) Inflation and stock market performance in India. https://doi.org/10.2307/2325486 | Google Scholar

- Mallik G., Chowdhury A.. (2001) Inflation and economic growth: Evidence from South Asian countries. Asian Pacific Development Journal 8: 123-135 https://doi.org/10.2307/2325486 | Google Scholar

- Menike L. M. C. S.. (2002) The effect of macroeconomic variables on stock prices in emerging Sri Lankan stock market. https://doi.org/10.2307/2325486 | Google Scholar

- Ibrahim M. S. (2023) Relationship between inflation and unemployment: Testing the applicability of Phillips curve to Nigeria. https://doi.org/10.2307/2325486 | Google Scholar

- Nene S. T. (2021) The effect of Inflation Targeting (IT) policy on the inflation uncertainty and economic growth in selected African and European countries. https://doi.org/10.2307/2325486 | Google Scholar

- Ozyilmaz A.. (2022) Relationship between inflation and economic growth in EU countries. https://doi.org/10.2307/2325486 | Google Scholar

- Reddy D. V. L.. (2012) Impact of inflation and GDP on stock market returns in India. https://doi.org/10.2307/2325486 | Google Scholar

- Rosyadi S. (2023) The effect of inflation on GDP with interest rates as a moderating variable. https://doi.org/10.2307/2325486 | Google Scholar

- Larmin S. F.. (Array) Analyzing the role of gold and oil prices, FDI, exchange rate, and inflation on GDP growth in Ghana. https://doi.org/10.2307/2325486 | Google Scholar

- Sailaja V. N., Mandal C.. (2018) An empirical study on impact of macro variables on sectoral indices in India. https://doi.org/10.2307/2325486 | Google Scholar

- Singh T., Mehta S., Varsha M. S.. (2010) Macroeconomic factors and stock returns: Evidence from Taiwan. https://doi.org/10.2307/2325486 | Google Scholar

- Srivastava A.. (2010) Relevance of macro-economic factors for the Indian stock market. https://doi.org/10.2307/2325486 | Google Scholar

- Tripathi V.. (2014) Relationship between inflation and stock returns – Evidence from BRICS markets using panel co-integration. https://doi.org/10.2307/2325486 | Google Scholar